All Categories

Featured

Table of Contents

When life quits, the dispossessed have no selection but to maintain moving. Virtually immediately, families have to manage the daunting logistics of fatality complying with the loss of an enjoyed one. This can include paying costs, dividing properties, and taking care of the burial or cremation. While death, like tax obligations, is unpreventable, it does not have to burden those left behind.

In addition, a complete death advantage is frequently given for unintended fatality. A changed death benefit returns premium commonly at 10% rate of interest if death takes place in the first 2 years and entails the most loosened up underwriting.

To underwrite this organization, firms rely upon personal health and wellness interviews or third-party data such as prescription histories, fraud checks, or automobile documents. Underwriting tele-interviews and prescription histories can usually be made use of to aid the agent finish the application process. Historically firms count on telephone interviews to verify or confirm disclosure, yet a lot more lately to boost client experience, companies are counting on the third-party information suggested over and giving instant choices at the factor of sale without the interview.

Open Care Funeral Insurance

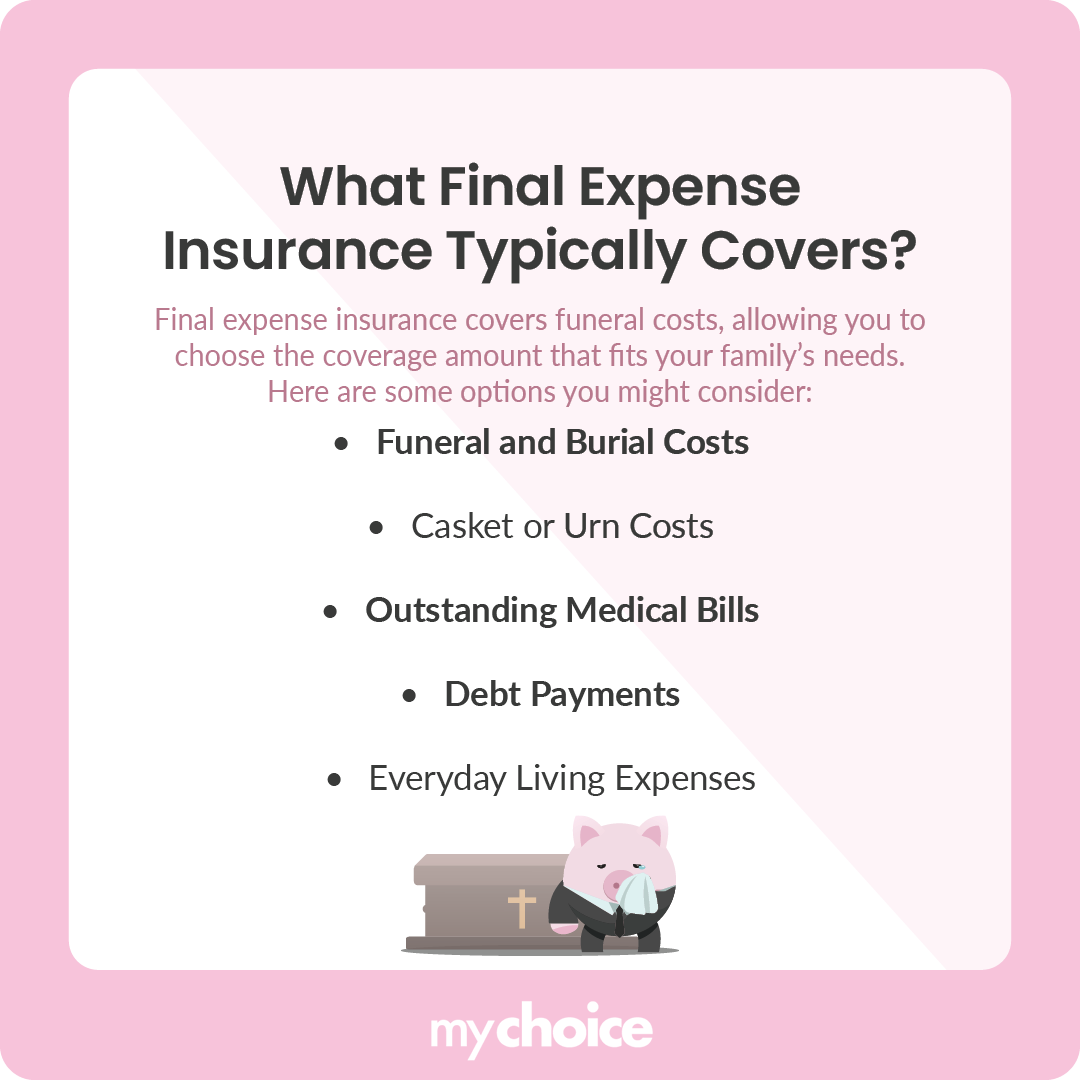

What is last expenditure insurance, and is it always the finest course ahead? Below, we have a look at exactly how final cost insurance functions and elements to think about before you get it. Technically, final cost insurance coverage is a entire life insurance policy plan particularly marketed to cover the expenses connected with a funeral, funeral, reception, cremation and/or burial.

While it is defined as a policy to cover final costs, beneficiaries that receive the fatality benefit are not needed to utilize it to pay for last costs they can utilize it for any kind of objective they such as. That's since last expense insurance policy really falls right into the classification of modified entire life insurance or simplified problem life insurance policy, which are generally whole life plans with smaller sized survivor benefit, often in between $2,000 and $20,000.

Affiliate links for the items on this web page are from companions that compensate us (see our advertiser disclosure with our list of partners for even more information). Our point of views are our own. See exactly how we rate life insurance policy products to write objective product testimonials. Interment insurance coverage is a life insurance policy policy that covers end-of-life expenses.

Price Of Funeral Insurance

Burial insurance policy requires no clinical test, making it easily accessible to those with clinical problems. This is where having burial insurance coverage, likewise recognized as final expenditure insurance policy, comes in convenient.

Simplified problem life insurance coverage calls for a wellness analysis. If your health standing disqualifies you from traditional life insurance, funeral insurance coverage may be a choice.

Compare inexpensive life insurance policy alternatives with Policygenius. Besides term and irreversible life insurance, funeral insurance can be found in numerous types. Have a look at your insurance coverage options for funeral service costs. Guaranteed-issue life insurance policy has no health and wellness needs and supplies fast authorization for coverage, which can be handy if you have severe, terminal, or numerous wellness conditions.

Funeral Cover For Over 65

Streamlined problem life insurance doesn't require a clinical examination, however it does call for a health and wellness survey. This plan is best for those with mild to moderate health problems, like high blood pressure, diabetes, or asthma. If you don't desire a medical test however can get a streamlined issue policy, it is usually a far better deal than an assured issue plan due to the fact that you can get more insurance coverage for a less costly costs.

Pre-need insurance policy is high-risk because the recipient is the funeral home and coverage specifies to the selected funeral home. Ought to the funeral home fail or you vacate state, you may not have coverage, and that beats the purpose of pre-planning. In addition, according to the AARP, the Funeral Consumers Alliance (FCA) discourages buying pre-need.

Those are essentially interment insurance coverage. For assured life insurance, costs estimations rely on your age, sex, where you live, and coverage amount. Understand that protection quantities are limited and vary by insurance provider. We discovered example quotes for a 51-year-woman for $25,000 in insurance coverage living in Illinois: You might decide to choose out of interment insurance policy if you can or have actually conserved up enough funds to pay off your funeral and any kind of superior financial debt.

Funeral insurance provides a simplified application for end-of-life insurance coverage. The majority of insurance policy companies need you to talk to an insurance agent to use for a plan and acquire a quote.

The goal of living insurance is to reduce the problem on your loved ones after your loss. If you have a supplemental funeral service plan, your loved ones can use the funeral policy to take care of final costs and get an immediate dispensation from your life insurance policy to deal with the home loan and education and learning expenses.

Individuals that are middle-aged or older with clinical problems may take into consideration interment insurance coverage, as they might not receive conventional policies with more stringent authorization criteria. In addition, interment insurance policy can be useful to those without extensive financial savings or conventional life insurance coverage. Interment insurance policy differs from other kinds of insurance coverage in that it uses a reduced survivor benefit, usually just adequate to cover expenditures for a funeral service and various other connected prices.

End Of Life Insurance Coverage

Information & Globe Record. ExperienceAlani has examined life insurance policy and pet dog insurance provider and has actually composed countless explainers on traveling insurance coverage, credit scores, financial obligation, and home insurance. She is passionate regarding debunking the intricacies of insurance and various other personal money subjects to ensure that viewers have the info they need to make the finest cash decisions.

Last expense life insurance coverage has a number of advantages. Last expense insurance is often suggested for seniors that may not certify for typical life insurance coverage due to their age.

Furthermore, last expenditure insurance coverage is advantageous for individuals that want to spend for their own funeral. Funeral and cremation services can be pricey, so last expense insurance provides comfort understanding that your enjoyed ones won't need to utilize their savings to spend for your end-of-life plans. Nonetheless, final cost protection is not the most effective product for everyone.

Life Insurance For Burial Costs

Getting entire life insurance coverage through Principles is quick and very easy. Coverage is readily available for seniors between the ages of 66-85, and there's no medical examination required.

Based on your reactions, you'll see your estimated price and the quantity of coverage you receive (in between $1,000-$30,000). You can buy a plan online, and your protection starts immediately after paying the initial premium. Your rate never changes, and you are covered for your whole lifetime, if you proceed making the month-to-month repayments.

When you offer final expense insurance coverage, you can provide your customers with the peace of mind that comes with knowing they and their households are prepared for the future. Prepared to learn whatever you require to recognize to start offering last expenditure insurance successfully?

Furthermore, clients for this sort of strategy can have serious lawful or criminal backgrounds. It's essential to note that various carriers supply a variety of concern ages on their assured issue policies as reduced as age 40 or as high as age 80. Some will certainly additionally provide higher stated value, up to $40,000, and others will permit much better fatality benefit problems by boosting the interest rate with the return of premium or decreasing the number of years until a complete death advantage is offered.

Latest Posts

Cheapest Final Expense Insurance

Final Expense Insurance To Age 90

Real Insurance Funeral Cover